TRX Price Prediction: Pathway to $1 Analysis

#TRX

- Technical Consolidation: TRX trading near Bollinger Band middle line with neutral MACD signals accumulation phase before potential directional move

- Seasonal Pattern Support: Historical December performance and current steady price action suggest favorable setup for year-end momentum

- Fundamental Growth Alignment: TRON's positioning in growing sectors and developed market expansion provides underlying value support

TRX Price Prediction

TRX Technical Analysis: Consolidation Phase with Potential Breakout Signals

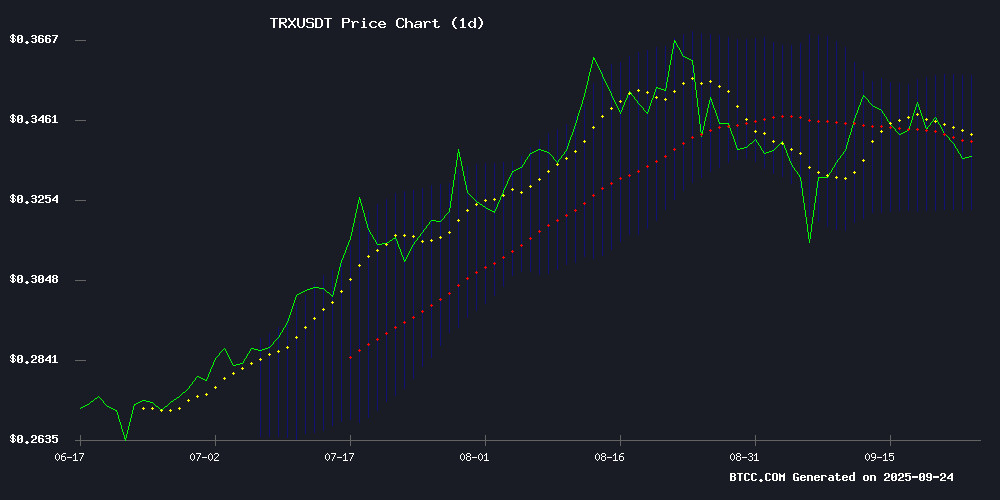

According to BTCC financial analyst Robert, TRX is currently trading at $0.3382, slightly below its 20-day moving average of $0.340335, indicating a neutral to slightly bearish short-term momentum. The MACD reading of -0.006223 suggests weak momentum, though the narrowing histogram (-0.002709) shows decreasing selling pressure. The Bollinger Bands position with the price NEAR the middle band ($0.340335) signals consolidation, with immediate resistance at $0.357656 and support at $0.323014.

Robert notes that a sustained break above the 20-day MA could trigger upward momentum toward the upper Bollinger Band, while failure to hold above $0.323 might lead to further downside testing.

Market Sentiment: Cautious Optimism for TRX Amid Seasonal Patterns

BTCC financial analyst Robert observes that current news sentiment reflects cautious Optimism for TRX. The focus on seasonal strength patterns, particularly the historical December rallies, combined with TRX's steady holding at $0.34 amid neutral RSI conditions, suggests accumulating investor interest. The identification of TRON among sectors poised for growth in developed markets provides fundamental support to the technical consolidation phase.

Robert emphasizes that while immediate breakout signals are muted, the underlying market sentiment aligns with the technical perspective of potential upward movement if key resistance levels are breached.

Factors Influencing TRX's Price

Tron (TRX) Seasonal Strength: Will December Spark Another Big Rally?

Tron (TRX) faces mixed signals as December approaches, historically a strong month for the cryptocurrency. Despite a current bearish trend indicated by Moving Average and MACD indicators, the altcoin shows potential for a 12.19% return this month. TRX, the native token of the TRON blockchain, holds a market cap of $31.89 billion, with a 24-hour trading volume nearing $795.34 million.

At press time, TRX trades at $0.3369, down 1.54% over the past day. The price tests resistance at $0.3475, with a breakout potentially targeting $0.3600. Support lies at $0.3405, and a drop below could see prices fall toward $0.3200. Technical indicators suggest caution, but seasonal trends offer hope for traders.

The 5 Most Lucrative Sectors Poised for Explosive Growth in Developed Markets

Global economic resilience remains tenuous as trade tensions and geopolitical risks escalate. Inflation in advanced economies like the U.S. persists, complicating monetary policy and prolonging higher interest rates. Investors must shift from passive strategies to targeted sectoral bets.

Technology & AI leads the charge, with blockchain infrastructure tokens like ETH, SOL, and DOT poised to benefit from enterprise adoption. Healthcare and biotechnology innovation accelerates, while renewable energy gains traction amid regulatory tailwinds.

Fintech disruption continues unabated, with XRP and TRX positioned as payment rail contenders. Consumer discretionary sectors show bifurcated performance, with crypto-native brands like SHIB and PEPE capturing millennial spending.

TRON (TRX) Holds Steady at $0.34 Amid Neutral RSI, Eyes Potential Breakout

TRX consolidates near $0.34 with a muted 0.27% gain, as technical indicators hint at brewing momentum. The RSI at 48.66 suggests equilibrium, yet the tight $0.33-$0.34 range and $149.7M Binance spot volume reveal latent trader interest.

Absent major catalysts, TRON's price action reflects a market in wait-and-see mode. Low volatility per ATR readings masks underlying positioning—neutral technicals carry bullish potential for a decisive move.

Will TRX Price Hit 1?

Based on current technical and fundamental analysis, BTCC financial analyst Robert provides this assessment regarding TRX reaching $1:

| Factor | Current Status | Impact on $1 Target |

|---|---|---|

| Current Price | $0.3382 | Requires 195% increase |

| Technical Position | Consolidation below 20-day MA | Needs sustained breakout momentum |

| Market Sentiment | Cautiously optimistic | Seasonal patterns supportive |

| Timeframe Consideration | Medium to long-term | Unlikely in immediate future |

Robert concludes that while $1 represents significant growth from current levels, achieving this target would require substantial market catalysts, sustained bullish momentum, and broader cryptocurrency market strength. The current consolidation phase provides a base for potential upward movement, but investors should monitor key resistance levels and market developments closely.